2024

Şekerbank receives US$160 million funding from six international financial institutions

Şekerbank has received a five-year, approximately US$160 million loan devoted entirely to social and environmental development with the participation of six international development financial institutions and impact investors under the lead arrangement of the Dutch Development Bank (FMO). The Japan International Cooperation Agency (JICA), which took part in the syndication in which a wide range of global-scale investors participated both directly and indirectly , has thus made its first private sector investment in Türkiye in Şekerbank.

Continuing on the path we set out to promote Anatolia's rural development, Şekerbank is the Sustainable Bank of Türkiye

To protect the sustainability of manufacturing and development in our country…

1953

Pancar Kooperatifleri Bankası A.Ş.

Şekerbank, Pancar Kooperatifleri Bankası A.Ş. was established in Eskişehir on October 12, 1953, with the savings of hundreds of thousands of beet farmers who are members of cooperatives in Anatolia. Thus, our bank opened its doors to the farmers, manufacturers to supply the financial needs of agriculture, agriculture-based industry, and manufacturing.

1956

Şekerbank Moved from Eskişehir to Ankara

The Head Office of Pancar Kooperatifleri Bankası A.Ş. moved from Eskişehir to Ankara. Our bank was renamed as “Şekerbank Türk Anonim Şirketi” with the approval of the Turkey’s Council of Ministers.

1970

Development of Products and Services

In the 1970s, representing the decade of development and change for Şekerbank, the transition from only cooperative banking services to a bank that offered all banking services and products began. In 1972, our first overseas representation was opened in Cologne, Germany. With the number of branches reaching 134, our bank laid the foundations of an inclusive banking approach.

1980

Focusing on Commercial Banking

By 1983, the number of branches had grown to 161 as part of this approach, which meant that Şekerbank would concentrate on commercial banking. Foreign trade transaction volume was increased, and correspondent relations were enforced. One of the first bank art galleries opened in Ankara, and the publication of Şeker Çocuk Magazine began as a first.

1993

Transition to Private Bank Status

Şekerbank's 10% share in Türkiye Şeker Fabrikaları A.Ş. was purchased from the Public Partnership administration by Şekerbank Personnel Social Insurance and Supplemental Funds and Pankobirlik. As a result, our bank ceased to be a public subsidiary and continued to provide services under the terms of a private sector bank.

1997

Initial Public Offering

The initial public offering was conducted, laying the groundwork for institutionalization. Our bank took another massive stride towards modern and contemporary banking with the excellent development project implemented simultaneously.

2000

Share Transfer

As the 51% share of the bank is assigned to Sekerbank T.A.Ş. Personnel of the Social Insurance Fund Foundation, Şekerbank T.A.Ş. and Şekerbank T.A.Ş personnel of the Supplementary Social Security and Solidarity Fund Foundation, the majority share changed.

2002

People-Oriented Banking

2002 was when the process of transforming into a multi-channel and customer-oriented bank began.

2003

Şekerbank: The Grand Bank that Turned over Half a Century

When Şekerbank reaches its 50th anniversary, it has become one of the essential cornerstones of the banking sector in Turkey.

2004

The Renewal of the Corporate Identity

Our Head Office was moved to Istanbul. Our corporate identity and logo were renewed.

2007

Turkey's Fastest-Growing Bank: Şekerbank

As a result of the diligent and disciplined implementation of the strategic business plan, our performance was also affected. In the "World's Top 1,000 Banks" research conducted by The Banker, an internationally prestigious publication, Şekerbank was ranked as the "sixth" among the top 50 banks with the fastest growth rate globally, earning the title of Turkey's fastest-growing bank.

2008

Receiving a Corporate Governance Rating

As a result of the evaluation made by ISS Corporate Service Inc., approved by the CMB, one of the world's most respected institutions in the branch of corporate governance, Şekerbank was awarded as the first Turkish bank to receive a corporate governance rating following the criteria of disclosure and transparency to shareholders, the board of directors, stakeholders, and public opinion.

2010

Introduction to the CDP Report

Our bank was one of five banks from Turkey listed in the CDP's (Carbon Disclosure Project) 2010 report, widely regarded as one of the world's leading platforms in the fight against climate change.

2011

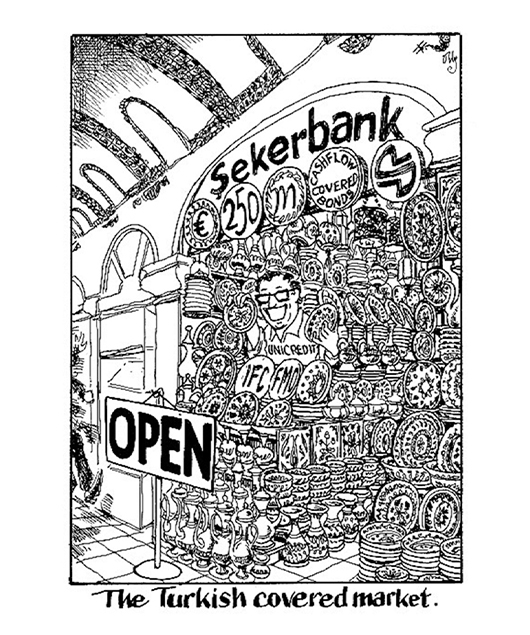

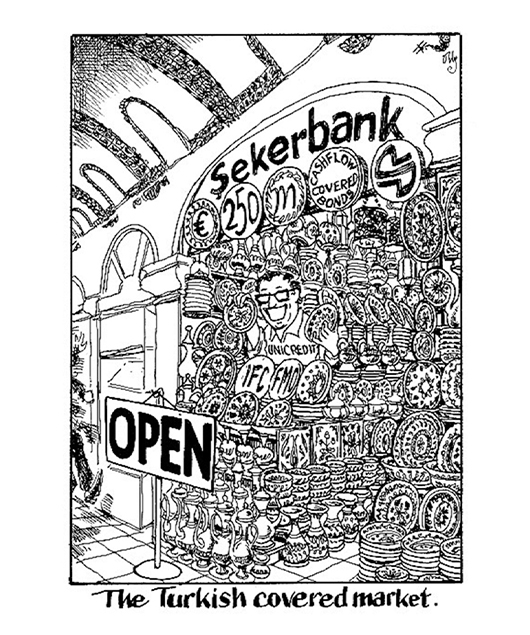

World's First SME Loans Secured Asset Guaranteed Securities Issuance

The first Turkish lira borrowing transaction organized in international markets, Asset-Backed Securities, was implemented, marking a first in Turkey and the world. Thanks to the Asset Guaranteed Securities issuance, Şekerbank started to act as an essential bridge between tradesmen and small businesses in Turkey and international financial institutions.

2013

The Platform of “Kapımız Esnafa Açık”

On the 60th anniversary of Şekerbank, the "Kapımız Esnafa Açık" platform, meaning "Our Doors Are Open to Tradespeople," a first for tradespeople, was founded. With the support of the Confederation of Turkey's Tradesmen and Craftsmen (TESK) and the conservation of the Ministry of Customs and Trade of Turkey, consumers were encouraged to shop from tradespeople through the "Kapımız Esnafa Açık" platform. The platform also gathers the public, private sector, NGOs, and consumers with tradespeople.

2014

A first in the World: "Family Farming Banking"

The "Family Farming Banking" project was carried out to decrease rural-urban migration and assist rural development. Thanks to the project, a significant awareness was created in public about the importance of agriculture and rural development.

2015

Moving to the New Head Office

Şekerbank's Headquarters have relocated to a new facility in Istanbul. The building, hosting the most important financial sector institutions, became a source of prestige for the bank, with its architecture representing Şekerbank's deep-rooted history.

2016

Leadership Award in Water Management

Şekerbank received the CDP 2016 Turkey Water Leadership Award after winning multiple environmental awards on national and international platforms for its innovative and pioneering work on energy efficiency.

2017

Şekerbank Signed the Sustainable Finance Statement

Şekerbank, in collaboration with six of Turkey's leading banks, signed the Sustainable Finance Statement, pledging to consider social and environmental considerations in project funding.

2018

Şekerbank is on the BIST Sustainability Index!

Şekerbank was included in the BIST Sustainability Index, which contains companies with outstanding corporate sustainability performance, and is listed on Borsa Istanbul for pioneering the financing of sustainable development to be Turkey's sustainable bank.

2019

Safer and Faster with New Data Center

Within the scope of the "Transformation Program," Şekerbank renewed its technological infrastructure overall and increased its efficiency to the next level by speeding up its operations four times faster with the new data center that was moved to the Headquarters facility, as well.

2020

Capital Increased by 61%

Established in 1953 with the cooperation of hundreds of thousands of small investors and farmers, Şekerbank increased its paid-in capital by 61% to TL 1.86 billion despite the global uncertainty that emerged with the COVID-19 epidemic.

2021

Digital Support for Manufacturing from Şekerbank

Şekerbank prioritized supporting manufacturing in its investments as part of its "Digital Transformation Program" and developed mobile, web, and tablet banking solutions for tradespeople, farmers, and SMEs, including many very firsts for them.

2022

International Credit Ratings Reveal Şekerbank’s Successful Performance

Within the scope of the "Digital Transformation Program", in which Şekerbank renewed its entire processes and technological infrastructure, the significant improvement in loan portfolio quality and the steps it took towards efficiency were reflected in its financial results and were effective in the increase in credit ratings. International Credit Rating Agency Fitch Ratings upgraded Şekerbank's Long-Term National Rating from BB+(tur) to BBB-(tur). Another International Rating Agency, Moody's, also upgraded the Bank's long-term ratings.

2023

Şekerbank receives USD 100 million in foreign funding from the US Government

A USD 100 million loan agreement was signed between Şekerbank and the US International Development Finance Corporation-DFC, a financial institution of the US Government, for the development of the region affected by the major earthquake disaster on February 06, 2023. With the addition of USD 33 million from Şekerbank's own resources, the total project amount reached USD 133 million.

2024

Şekerbank receives US$160 million funding from six international financial institutions

Şekerbank has received a five-year, approximately US$160 million loan devoted entirely to social and environmental development with the participation of six international development financial institutions and impact investors under the lead arrangement of the Dutch Development Bank (FMO). The Japan International Cooperation Agency (JICA), which took part in the syndication in which a wide range of global-scale investors participated both directly and indirectly , has thus made its first private sector investment in Türkiye in Şekerbank.

Continuing on the path we set out to promote Anatolia's rural development, Şekerbank is the Sustainable Bank of Türkiye

To protect the sustainability of manufacturing and development in our country…

1953

Pancar Kooperatifleri Bankası A.Ş.

Şekerbank, Pancar Kooperatifleri Bankası A.Ş. was established in Eskişehir on October 12, 1953, with the savings of hundreds of thousands of beet farmers who are members of cooperatives in Anatolia. Thus, our bank opened its doors to the farmers, manufacturers to supply the financial needs of agriculture, agriculture-based industry, and manufacturing.

1956

Şekerbank Moved from Eskişehir to Ankara

The Head Office of Pancar Kooperatifleri Bankası A.Ş. moved from Eskişehir to Ankara. Our bank was renamed as “Şekerbank Türk Anonim Şirketi” with the approval of the Turkey’s Council of Ministers.

1970

Development of Products and Services

In the 1970s, representing the decade of development and change for Şekerbank, the transition from only cooperative banking services to a bank that offered all banking services and products began. In 1972, our first overseas representation was opened in Cologne, Germany. With the number of branches reaching 134, our bank laid the foundations of an inclusive banking approach.

1980

Focusing on Commercial Banking

By 1983, the number of branches had grown to 161 as part of this approach, which meant that Şekerbank would concentrate on commercial banking. Foreign trade transaction volume was increased, and correspondent relations were enforced. One of the first bank art galleries opened in Ankara, and the publication of Şeker Çocuk Magazine began as a first.

1993

Transition to Private Bank Status

Şekerbank's 10% share in Türkiye Şeker Fabrikaları A.Ş. was purchased from the Public Partnership administration by Şekerbank Personnel Social Insurance and Supplemental Funds and Pankobirlik. As a result, our bank ceased to be a public subsidiary and continued to provide services under the terms of a private sector bank.

1997

Initial Public Offering

The initial public offering was conducted, laying the groundwork for institutionalization. Our bank took another massive stride towards modern and contemporary banking with the excellent development project implemented simultaneously.

2000

Share Transfer

As the 51% share of the bank is assigned to Sekerbank T.A.Ş. Personnel of the Social Insurance Fund Foundation, Şekerbank T.A.Ş. and Şekerbank T.A.Ş personnel of the Supplementary Social Security and Solidarity Fund Foundation, the majority share changed.

2002

People-Oriented Banking

2002 was when the process of transforming into a multi-channel and customer-oriented bank began.

2003

Şekerbank: The Grand Bank that Turned over Half a Century

When Şekerbank reaches its 50th anniversary, it has become one of the essential cornerstones of the banking sector in Turkey.

2004

The Renewal of the Corporate Identity

Our Head Office was moved to Istanbul. Our corporate identity and logo were renewed.

2007

Turkey's Fastest-Growing Bank: Şekerbank

As a result of the diligent and disciplined implementation of the strategic business plan, our performance was also affected. In the "World's Top 1,000 Banks" research conducted by The Banker, an internationally prestigious publication, Şekerbank was ranked as the "sixth" among the top 50 banks with the fastest growth rate globally, earning the title of Turkey's fastest-growing bank.

2008

Receiving a Corporate Governance Rating

As a result of the evaluation made by ISS Corporate Service Inc., approved by the CMB, one of the world's most respected institutions in the branch of corporate governance, Şekerbank was awarded as the first Turkish bank to receive a corporate governance rating following the criteria of disclosure and transparency to shareholders, the board of directors, stakeholders, and public opinion.

2010

Introduction to the CDP Report

Our bank was one of five banks from Turkey listed in the CDP's (Carbon Disclosure Project) 2010 report, widely regarded as one of the world's leading platforms in the fight against climate change.

2011

World's First SME Loans Secured Asset Guaranteed Securities Issuance

The first Turkish lira borrowing transaction organized in international markets, Asset-Backed Securities, was implemented, marking a first in Turkey and the world. Thanks to the Asset Guaranteed Securities issuance, Şekerbank started to act as an essential bridge between tradesmen and small businesses in Turkey and international financial institutions.

2013

The Platform of “Kapımız Esnafa Açık”

On the 60th anniversary of Şekerbank, the "Kapımız Esnafa Açık" platform, meaning "Our Doors Are Open to Tradespeople," a first for tradespeople, was founded. With the support of the Confederation of Turkey's Tradesmen and Craftsmen (TESK) and the conservation of the Ministry of Customs and Trade of Turkey, consumers were encouraged to shop from tradespeople through the "Kapımız Esnafa Açık" platform. The platform also gathers the public, private sector, NGOs, and consumers with tradespeople.

2014

A first in the World: "Family Farming Banking"

The "Family Farming Banking" project was carried out to decrease rural-urban migration and assist rural development. Thanks to the project, a significant awareness was created in public about the importance of agriculture and rural development.

2015

Moving to the New Head Office

Şekerbank's Headquarters have relocated to a new facility in Istanbul. The building, hosting the most important financial sector institutions, became a source of prestige for the bank, with its architecture representing Şekerbank's deep-rooted history.

2016

Leadership Award in Water Management

Şekerbank received the CDP 2016 Turkey Water Leadership Award after winning multiple environmental awards on national and international platforms for its innovative and pioneering work on energy efficiency.

2017

Şekerbank Signed the Sustainable Finance Statement

Şekerbank, in collaboration with six of Turkey's leading banks, signed the Sustainable Finance Statement, pledging to consider social and environmental considerations in project funding.

2018

Şekerbank is on the BIST Sustainability Index!

Şekerbank was included in the BIST Sustainability Index, which contains companies with outstanding corporate sustainability performance, and is listed on Borsa Istanbul for pioneering the financing of sustainable development to be Turkey's sustainable bank.

2019

Safer and Faster with New Data Center

Within the scope of the "Transformation Program," Şekerbank renewed its technological infrastructure overall and increased its efficiency to the next level by speeding up its operations four times faster with the new data center that was moved to the Headquarters facility, as well.

2020

Capital Increased by 61%

Established in 1953 with the cooperation of hundreds of thousands of small investors and farmers, Şekerbank increased its paid-in capital by 61% to TL 1.86 billion despite the global uncertainty that emerged with the COVID-19 epidemic.

2021

Digital Support for Manufacturing from Şekerbank

Şekerbank prioritized supporting manufacturing in its investments as part of its "Digital Transformation Program" and developed mobile, web, and tablet banking solutions for tradespeople, farmers, and SMEs, including many very firsts for them.

2022

International Credit Ratings Reveal Şekerbank’s Successful Performance

Within the scope of the "Digital Transformation Program", in which Şekerbank renewed its entire processes and technological infrastructure, the significant improvement in loan portfolio quality and the steps it took towards efficiency were reflected in its financial results and were effective in the increase in credit ratings. International Credit Rating Agency Fitch Ratings upgraded Şekerbank's Long-Term National Rating from BB+(tur) to BBB-(tur). Another International Rating Agency, Moody's, also upgraded the Bank's long-term ratings.

2023

Şekerbank receives USD 100 million in foreign funding from the US Government

A USD 100 million loan agreement was signed between Şekerbank and the US International Development Finance Corporation-DFC, a financial institution of the US Government, for the development of the region affected by the major earthquake disaster on February 06, 2023. With the addition of USD 33 million from Şekerbank's own resources, the total project amount reached USD 133 million.

2024

Şekerbank receives US$160 million funding from six international financial institutions

Şekerbank has received a five-year, approximately US$160 million loan devoted entirely to social and environmental development with the participation of six international development financial institutions and impact investors under the lead arrangement of the Dutch Development Bank (FMO). The Japan International Cooperation Agency (JICA), which took part in the syndication in which a wide range of global-scale investors participated both directly and indirectly , has thus made its first private sector investment in Türkiye in Şekerbank.

1950

1970

1980

1990

2000

2010

2020

For 72 years, we have proudly carried out our aim of being Türkiye's Sustainable Bank!

Our Mission

From village to city, with the understanding of “Community Banking" and within the scope of modern banking, we consider local characteristics and needs. We introduce banking services to those who do not have, grow together by creating value with its delighted customers, workers, and partners, and draw strength from the deep-rooted history.

Our Vision

As the "leading bank in funding small enterprises," our vision is to be among Türkiye's top ten private banks in terms of total assets.

Our Banking Services in Numbers

We work for financing sustainable agriculture.

We continue to promote agriculture as a bank that has served farmer families across Türkiye for three generations. We allow farmers to access greater resources through our agricultural banking activities.

350Thousand +

131

We continue to work for more tradespeople and businesses to reach financial resources in the future for all segments to be included in the economy with production.

We work to support the producers and especially female producers to introduce banking services and bring our digital applications to tradespeople and businesses.

24%

61%

1355

We are with our SMEs that support export and import

We support SMEs at every scale as the soul of the national economy in terms of production, investment, employment and export.

60,7%

14,8%

153

194

We continue to be a solution partner for corporate and commercial firms and support their growth.

We strengthen our sustainability-themed value chain by providing the financing needed by our manufacturing and exporting companies for purposes such as green transformation, energy efficiency, and carbon emission reduction.

We offer custom, different and fast private banking solutions for changing customer needs

We concentrate on niche segments in retail banking by quickly providing personalized solutions through our branches, the majority of which have been servicing the same place for more than half a century, and our local banking expertise, in response to changing customer needs and demands.

34,5Billion TL